Most people have a hard time understanding what superannuation is. So how do you know whether you should put more of your money into super?

What is Superannuation?

Think of superannuation as a savings account. Your employer puts money into your super savings account during your working life for when you retire.

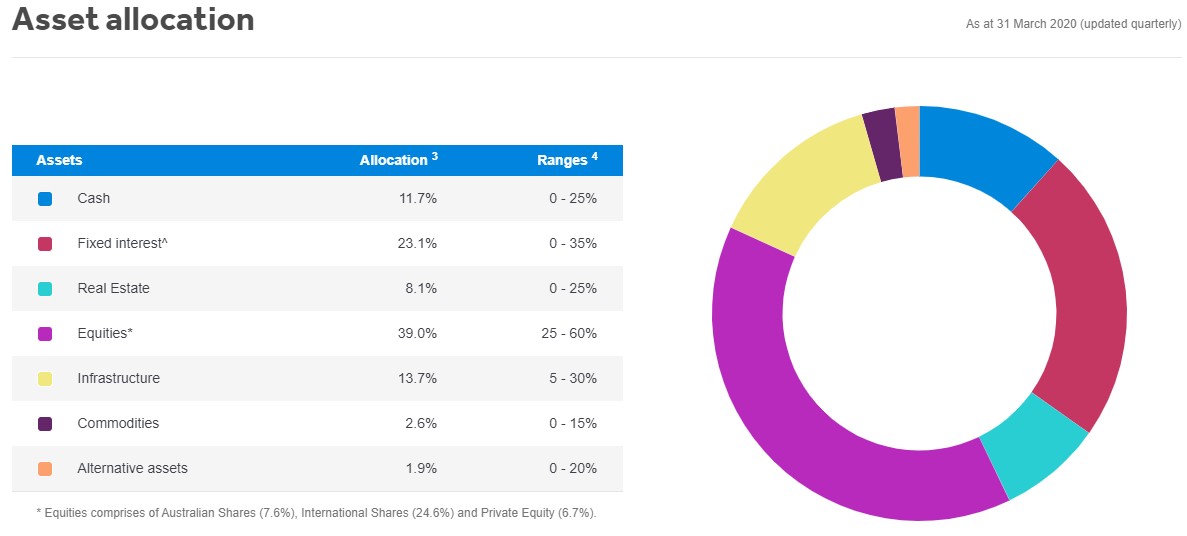

The money in your super savings account is then invested by your superannuation provider. See below investment strategy for Balanced Superannuation Fund.

Using the above example, if you had $100,000 in super, this would mean that 39% or $39,000 would be in equities (Australian and International shares).

Recently, most people have probably noticed that their superannuation has fallen. This is largely due to the shares in your superannuation. Using the above figures if shares fell by half their value, the $39,000 amount is now $19,500. Meaning that the $100,000 has been reduced to $80,500.

Shares have fallen lately due to COVID-19. With the exception of the last 6 months, the sharemarket has performed quite well for the past decade, returning 11.2%pa (Fidelity 30 years in Australian and global shares Dec 2019.)

NOW is the time!

Because shares have fallen in value, so have superannuation funds. If you were to contribute extra to your superannuation now and shares were to perform at similar returns for the next 10 years you’d be buying shares at the lowest price they’ve been in 10 years.

If you’d like to know whether your money is invested appropriately to take advantage of your superannuation, please don’t hesitate to contact Dean at Financial Advisers Australia Group.