Superannuation Contributions

Salary Packaging

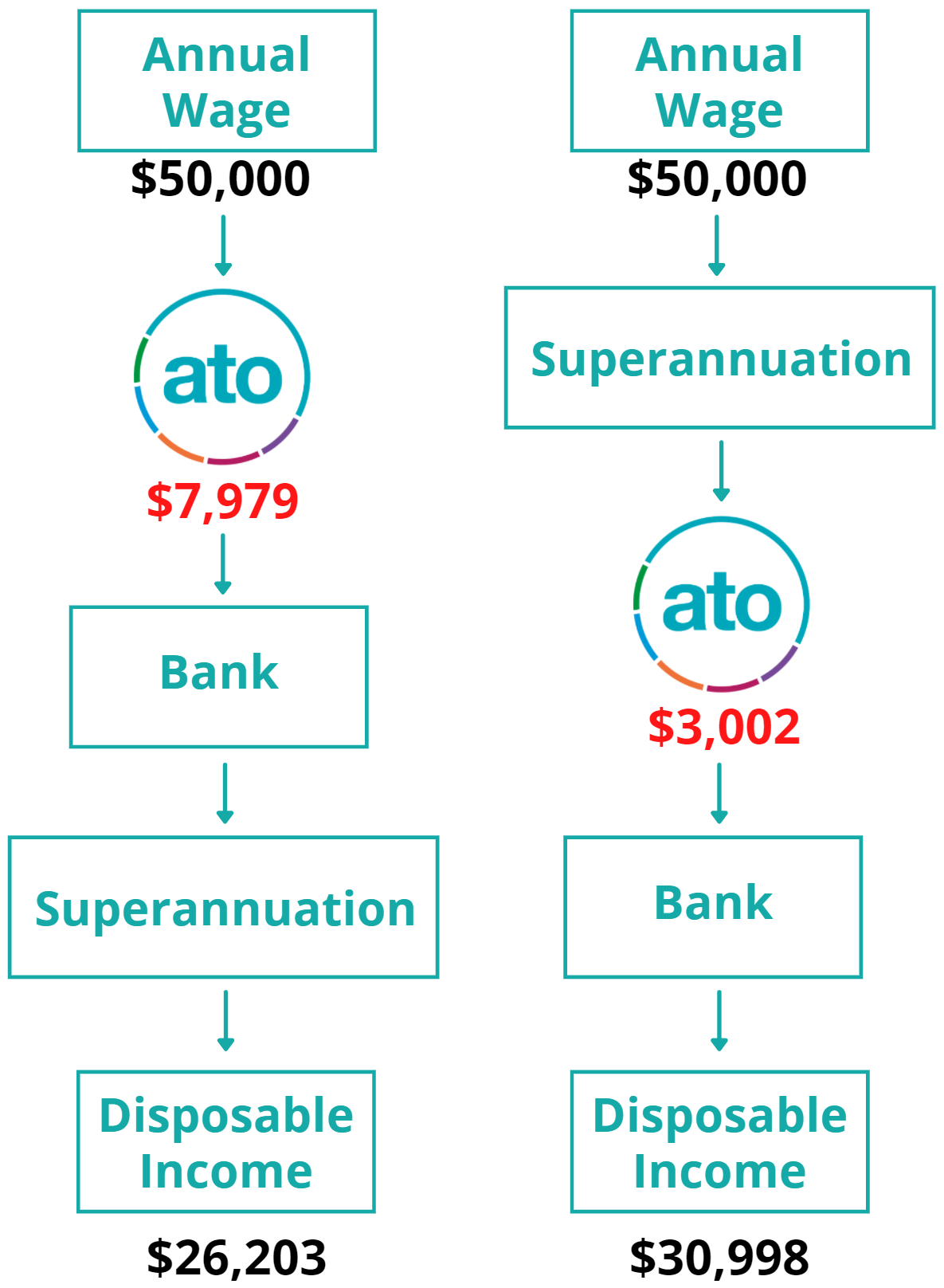

Additional contributions into your Super Fund has significant benefits to be considered as highlighted below:

- Salary Packaging Contributions into your Superannuation does not count towards any Exemption Cap or Rebatable Cap limits – these contributions are all made in addition to your Cap allowance.

- The Superannuation Contributions Cap (Limit) is $27,500 per tax year (1 July to 30 June) for Pre-Tax contributions from both the Employer and Employee

- Your Superannuation Fund pays 15% Contributions Tax to the ATO on these Pre-Tax Superannuation Contributions

- The Superannuation Contributions Cap (Limit) is $27,500 – this is applicable to all of your Super Funds combined including a SMSF

- You can Salary Package additional Contributions to your spouse’s Super Fund

- Generally, making extra Concessional Contributions into your Super Fund is tax effective if you earn more than $45,000 per year.

- You NEED to consider ALL of your personal circumstances before committing to additional voluntary contributions into your Fund, so seek financial advice before proceeding with additional contributions.